Have you ever had a time where, financially, everything seems to be going perfectly? Your bills are paid in full, and on time. Your savings account is growing? And suddenly, you have a $1,700 car repair, a $650 medical bill comes due, and to top it off, your sinking funds can’t cover them? Stability is a fundamental piece of financial planning, and building an emergency fund is crucial for that stability. By being proactive

Begin With A Savings Goal In Mind

The first step to getting where you want to go is knowing where you want to go! Determine how much money you want to save in your emergency fund. The most common is 3 – 6 months of living expenses, but you can adjust that number based on your needs.

What’s your Current Financial Situation?

Assessing your current income, savings and expenses helps you understand your current financial situation.

Calculate your average living expenses per month, make sure to include fixed expenses like your rent or mortgage, insurance premiums, etc, as well as any variable expenses, like food, transportation costs, utilities, and other essential costs.

Cut Any Unnecessary Expenses

After you’ve assessed where you are financially, you can easily identify areas where you need to cut back spending to redirect those funds to an emergency fund.

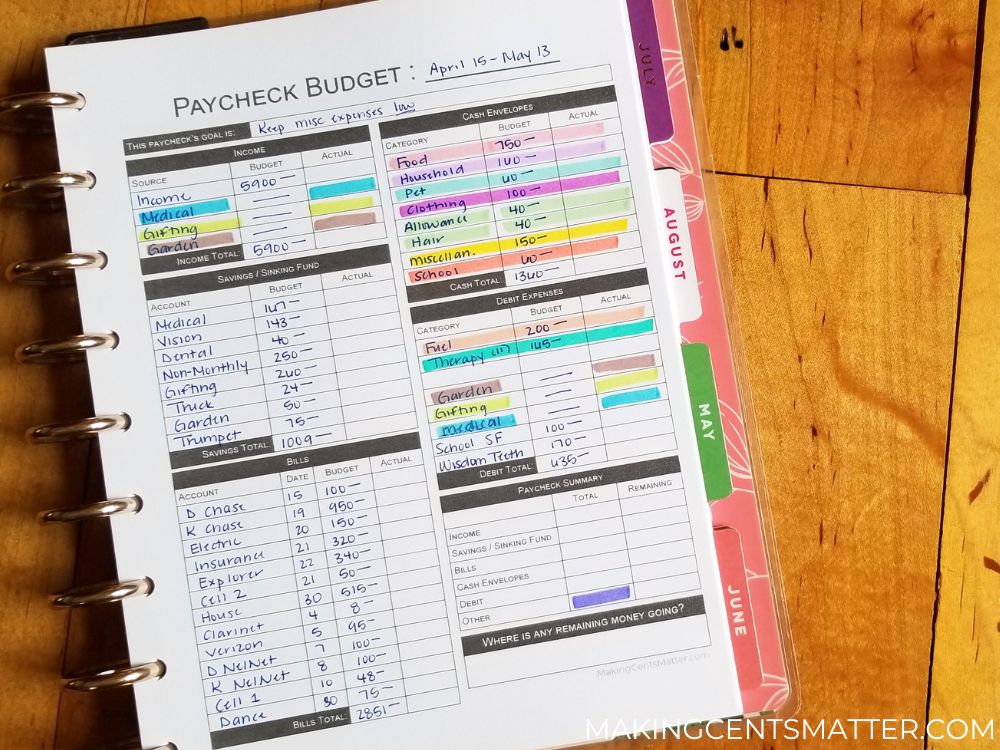

Create A Budget

Your budget needs to reflect your priority of building your emergency fund. This helps make sure that your financial goals are reflected, allowing you room for more contributions to your emergency fund.

Click here to learn how to build a Zero-Based Budget.

Open A Separate Savings Account

Have a separate account that is dedicated to only your emergency fund. The separation is two-fold.

- It makes tracking your progress so much easier,

- It prevents you from spending accidentally spending the money.

Building an emergency fund in a separate account also helps you resist the temptation of dipping into the money for non-emergency expenses.

Consider A High-Interest Savings Account

In order to maximize the growth of your emergency fund over time, consider keeping it in a high-interest savings account. Remember to research the banks first, and choose based on which suits your needs best.

Start Small, and Be Consistent

If your emergency fund goal is $15,000, you cannot be expected to save it all at once.

Instead, start with a smaller, more achievable goal, like $5,000 throughout the year. That’s about $416 a month, or $96 a week.

Breaking the goal into smaller steps makes it more manageable.

Automate Savings If You Can

Setting up small transfers to your emergency fund helps treat building an emergency fund as if it is a non-negotiable expense, similar to a bill, helping you to create a consistent savings schedule.

Use Any Unexpected Money You Receive

When you receive unexpected money, direct it towards building your emergency fund. Examples can include tax refunds, work bonuses, raises, and gifts.

Not only can unexpected funds accelerate your savings growth, but they can help you reach your overall financial goals as well.

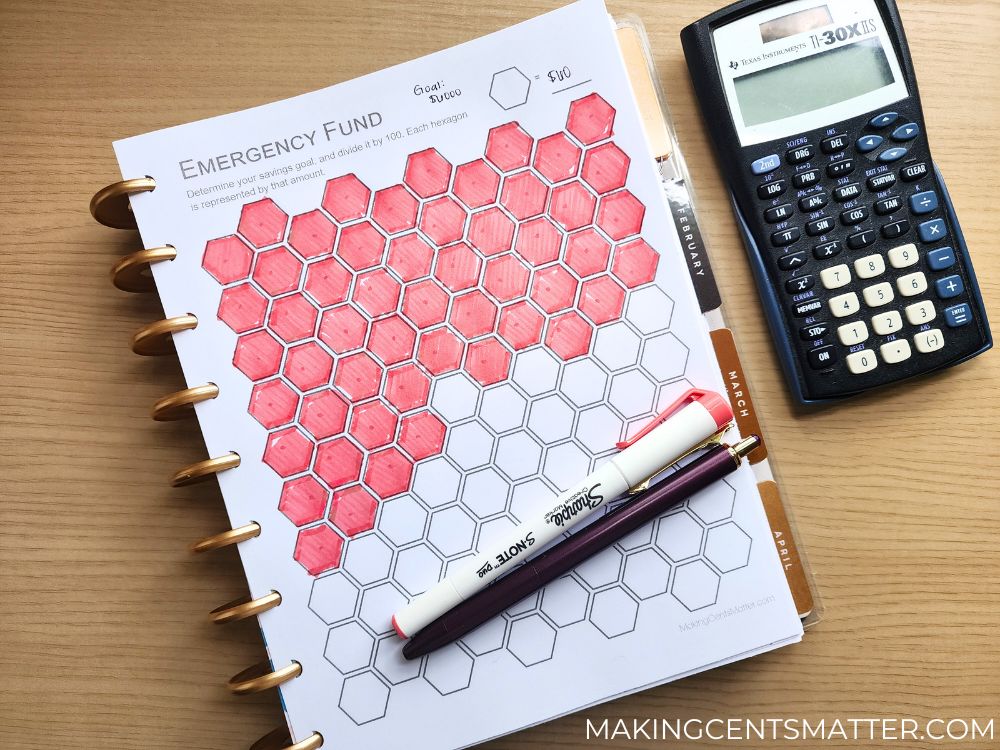

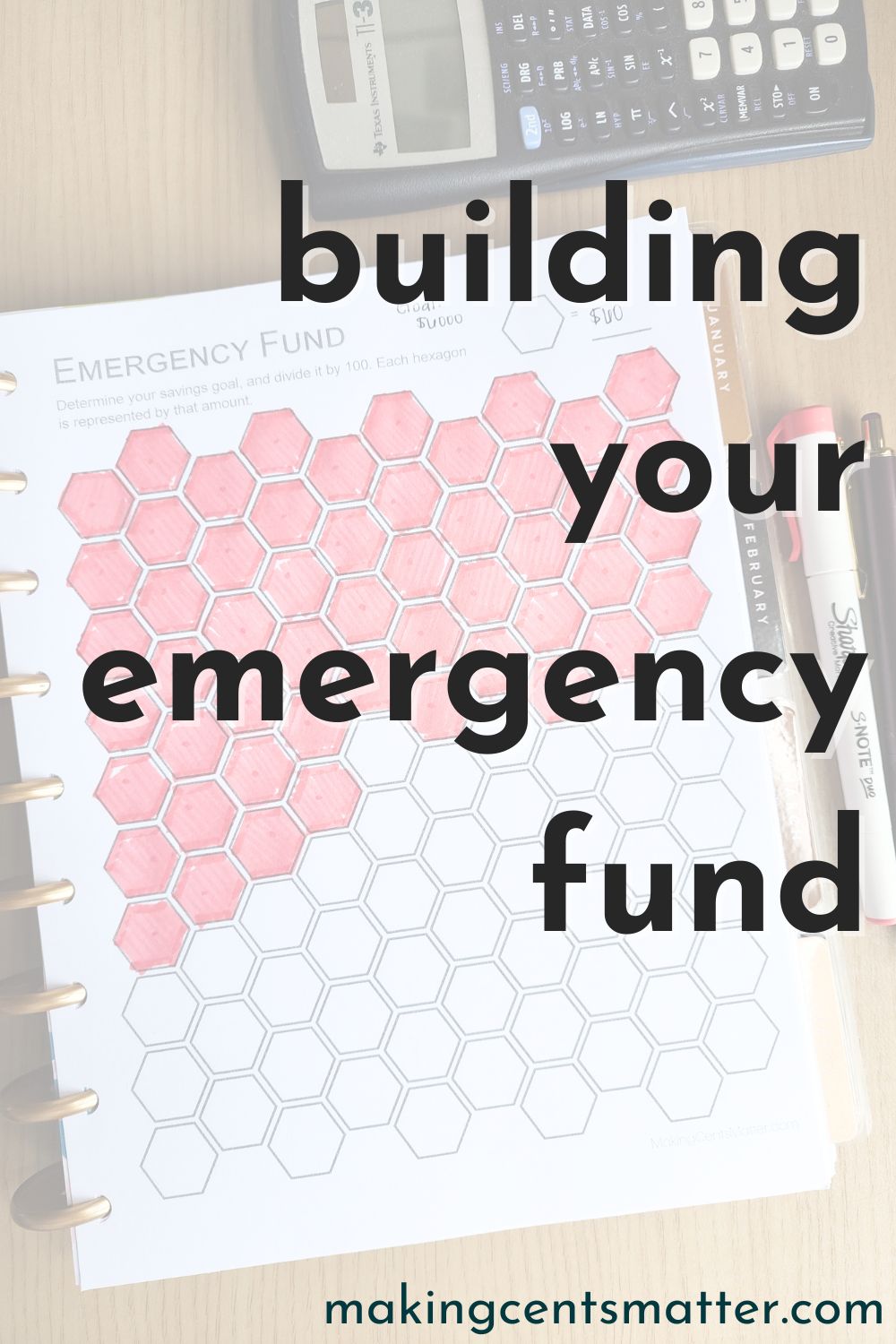

Track Your Progress with a savings tracker

Tracking the progress you make on your emergency fund helps you feel accomplished, but it also helps you remain committed to your overall financial goals.

Whether you use a notebook, a budgeting app, or my free printable in my Resource Library, be sure to regularly track and review your progress.

Replenish After You Use

If you wind up using your emergency fund, readjust your savings goals to ensure that replenishing it becomes a priority. Once you are back on track, you can resume your regular contributions towards your financial goals.

Regularly Review & Adjust

Reviewing and adjusting your savings goals based on your living expenses is crucial for building your emergency fund. Your circumstances within life can change – whether a child goes off to college, or you are going through a divorce – and your emergency fund should adapt to those changes accordingly.

An emergency fund is a crucial piece to your overall financial health, as well as your financial stability. Not only is it a safety net, but it serves as a place to have funds readily available without relying on credit cards or personal loans. By following these 8 steps, you can easily build an emergency fund that can meet your financial needs.

Leave a Reply