Sinking funds are an essential tool for your financial planning. They encourage good financial habits and help to create financial stability. Here is my complete guide to sinking funds for beginners.

Note: This is a reformatted version of a previous post. Please READ THIS if you’d like more information.

What Is The Purpose Of Sinking Funds?

When you look at your calendar, you can see that planned expenses are coming up in the future. It could be as simple as an anniversary or a birthday, property taxes, and a 6-month car insurance premium.

Rather than paying out the entire expense all at once from your regular income, or a savings account – like your emergency fund – a sinking fund is created to cover the cost of those future expenses.

When the anticipated expense occurs, you already have the funds to cover it! With the funds on hand, you avoid dipping into emergency savings or using credit cards.

To me, sinking funds are considered the MVP of your budget. When the funds are set up properly, they can be the “make it or break it” portion of your budget. Sinking funds can help you maintain financial stability, and reach your long-term financial goals.

What are some examples of sinking funds?

Sinking funds are used to cover a wide range of upcoming, planned expenses. Since it deals with upcoming expenses, your sinking funds will change with your budgeting needs. Here are some of the sinking funds you may want as a part of your budget:

- Emergency Fund: your emergency fund can be a type of sinking fund! You can read more about how to build and track an emergency fund here. While your emergency fund is not a sinking fund for a specific expense, it is crucial to have it in case of job loss, medical emergencies, or major repairs.

- Car Maintenance & Repairs: No matter the age of your car, they all will require maintenance and repairs. Setting aside money regularly for oil changes, tire replacements, brake replacements, and any unexpected repairs will prevent strains on your budget when these expenses arise.

- Vacation Fund: Rather than putting your vacations on credit cards, have a dedicated fund that you can save money in for your travel expenses, lodging, and any activities you plan. This means your vacation is much more relaxing knowing that you aren’t going into more debt in the process!

- Home Maintenance & Repairs: Nothing is worse than waking up to see your water heater leaking all over your floor. Setting aside money for home maintenance, repairs, and updates makes these moments in life far less stressful without added financial strain.

- Medical Fund: Even if you are healthy, saving up a medical fund ensures that any emergency or urgent care visit can be covered, along with any copays and deductibles. What amount you leave in the fund is up to you and what your anticipated expenses are. Personally, I like to keep our family’s out-of-pocket maximum as our sinking fund amount.

- Gifting Fund: Setting aside money regularly for holidays, birthdays, weddings, and anniversaries guarantees that you can celebrate these special events without financial strain.

What sinking funds you have is going to change depending on the needs of your budget.

Remember, your budget is ever-changing, and what sinking funds you need will change as well. This is why consistency (not monotony) is key when it comes to budgeting.

How To Build A Sinking Fund

Before you start building a sinking fund, you need to know a few things.

- What expenses are coming up in your future? This is what your sinking fund will be for.

- About how much you will need for those expenses.

- How many paychecks do you have before you need to pay the expense?

Once you have all that information, it’s time to calculate!

For example, if you have a $700 property tax bill coming up, and you only have 4 monthly paychecks before you need to pay it, you’ll want to set aside $175 per paycheck.

Or maybe you have a $250 trumpet cleaning due in the summer – after the spring band concerts, but before marching band starts. If you have 9 weekly paychecks before the cleaning is scheduled, you’ll want to set aside about $28 per weekly paycheck.

Make sure that you leave room in your budget for these contributions!

By contributing to a sinking fund regularly, the amount of financial strain you experience per pay period is diminished, and the full amount is saved by the time the expense comes due.

As with anything, regularly reviewing and adjusting is necessary to make sure that you remain within your budget, and still on track to meet your saving goals.

Benefits To Having Sinking Funds

Budget Control

Maintaining better control over your budget and cash flow is an incredible benefit to creating sinking funds. By regularly setting aside specific amounts of money for future expenses, you ensure the funds are already available when they are needed.

Avoiding Debt

Creating sinking funds allows you to pay for upcoming, planned expenses with your own money rather than adding the expense to credit cards or loans. Not only does it save you from paying more in interest rates and debt accumulation, it allows for more financial freedom.

Goal Achievements

Nothing keeps the ball rolling like meeting small goals. By contributing to a sinking fund regularly, you are creating momentum to reach your financial goals.

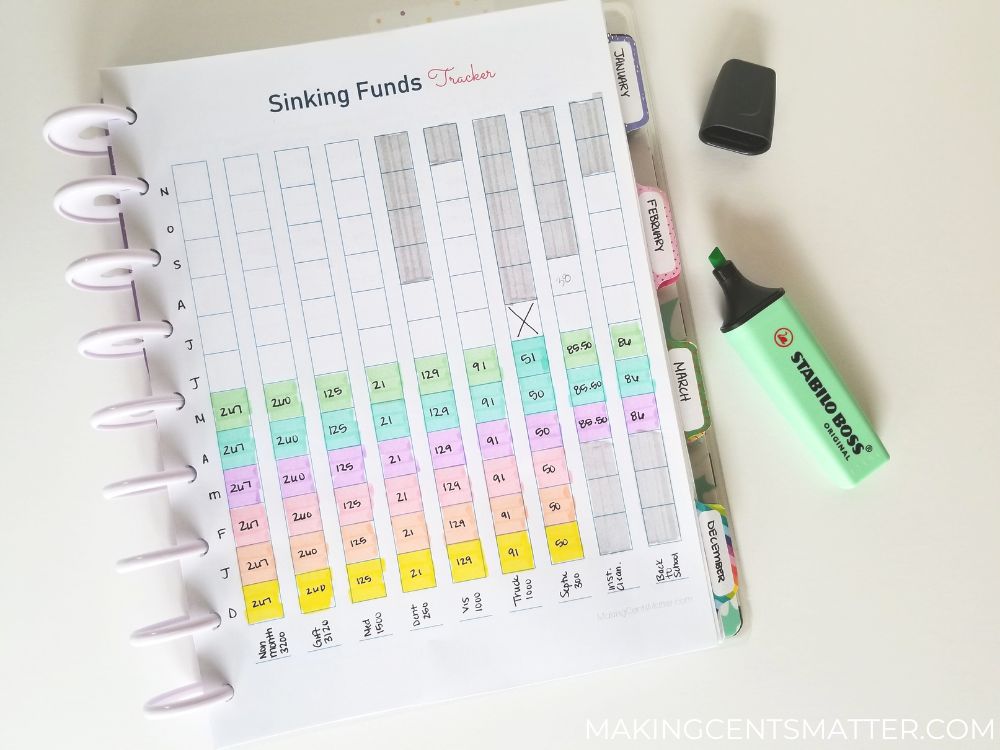

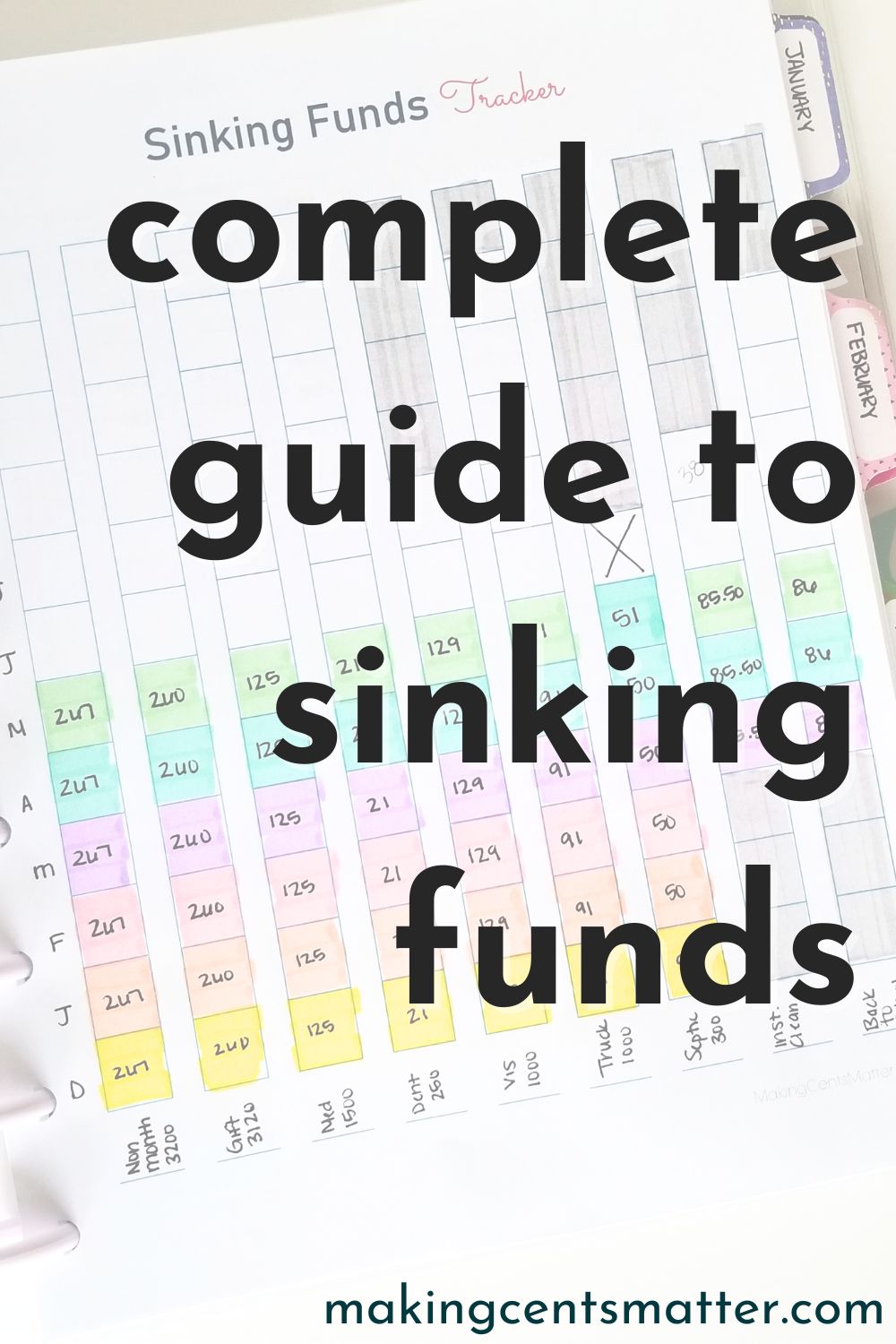

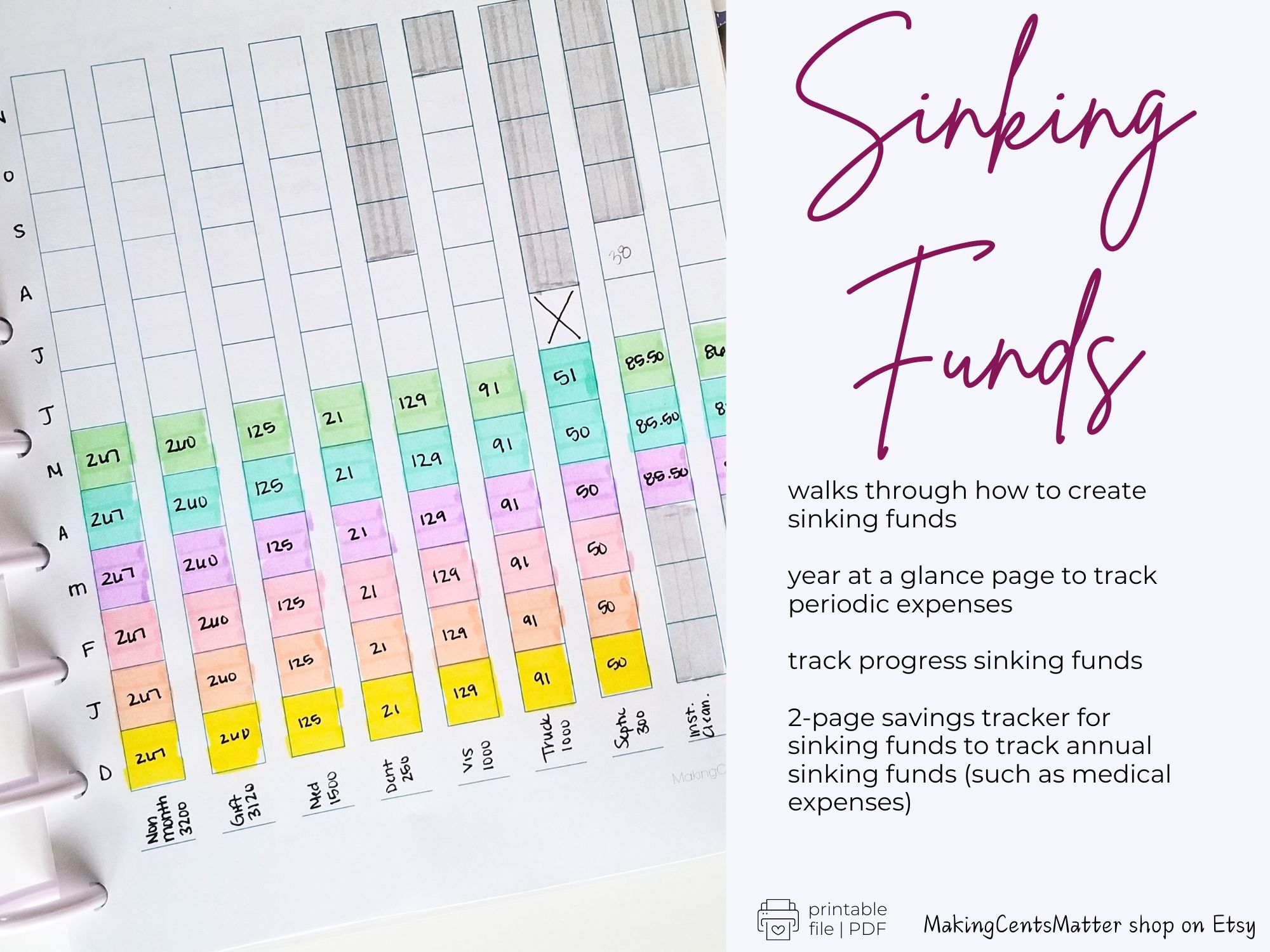

To help keep track of your sinking funds, I have a free printable tracker in my Resource Library. Click on the image above to sign up for access.

Leave a Reply