If you’re one of the 40% of people who are paid bi-weekly, or twice a month, you know the struggle to balance bills and variable expenses. They never seem to align with your pay periods, leaving you in almost a feast-famine cycle. The half-payment budget method helps you to break down your expenses into manageable portions, which leaves you with a more consistent amount each pay period for variable expenses.

Note: This is a reformatted version of a previous post. Please READ THIS if you’d like more information.

What is the half-payment budget method:

The half-payment budget method is a strategy where you divide your fixed expenses in half. This means that one paycheck covers half of your expenses and the other paycheck covers the other half. This method helps reduce the uneven balance between bills and expenses that may be grouped toward the beginning or the end of the month.

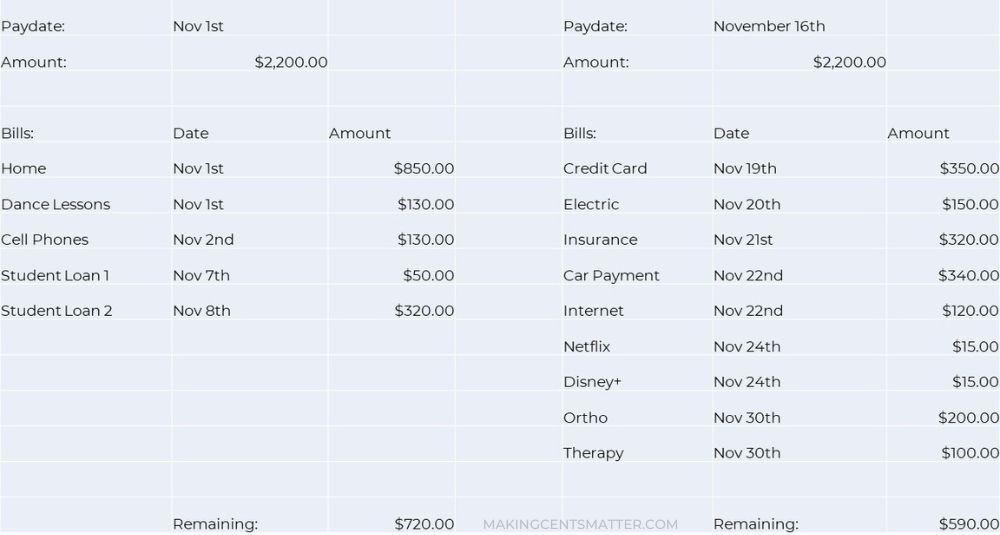

Here is an example of how the method could work with a sample budget. In this example, the second paycheck of the month has a lot more fixed expenses, leaving little room for variable expenses.

But by dividing the fixed expenses in half, you’ve taken some of that burden off of one paycheck and split it across both. This ensures you have a consistent amount after each pay period for your variable expenses.

How do I determine what Amount needs to be saved:

In my Resource Library, I have a free printable to help you determine what amount needs to be saved up.

Write out all the bills and fixed expenses that you have, along with their due dates and amounts that you have budgeted. Then divide that amount in half. That is your target to save up for that particular bill.

Like any other savings goal, it will take a little bit to save up the amount that is needed for this budget method to work effectively.

After you have the amount saved, you no longer need to worry about your fixed expenses taking up the majority of your paycheck.

To continue using the method, make sure that you continue to save half of your expenses from each paycheck. When the bill is due, use the amount that has already been put aside to pay the bills that are currently due. This ensures you have consistent funds on hand for your bills and variable expenses.

Do you use the half-payment budget method? What was the hardest part of getting started? Let me know in the comments below!

Leave a Reply